Learn About Affordable Appliances Clearance Sales

Introduction and Outline

Clearance is not chaos; it’s choreography. Every red sticker, endcap, and rolling rack reflects a planned decision to convert slow-moving stock into cash, free up space, and reset the stage for the next act in the product cycle. Understanding this is helpful whether you’re a shopper seeking value or a store operator working to balance space, sales, and profit. In retail, time is often the most expensive inventory cost: the longer an item sits, the more it consumes interest, storage, and opportunity.

Before we dive in, here’s the roadmap we’ll follow to turn those markdowns into meaning:

– Retail clearance basics: why markdowns happen, how they’re scheduled, and how store space pressures shape decisions.

– Inventory turnover: the math behind velocity, what it signals about merchandising, and how clearance fits into the equation.

– Product cycles: the life stages of items and how transitions drive pricing, presentation, and timing.

– Shopper timing: subtle cues that a deeper markdown is near and practical guardrails for quality and warranty checks.

– Store operations: playbooks for orderly markdowns that protect margin, reputation, and customer trust.

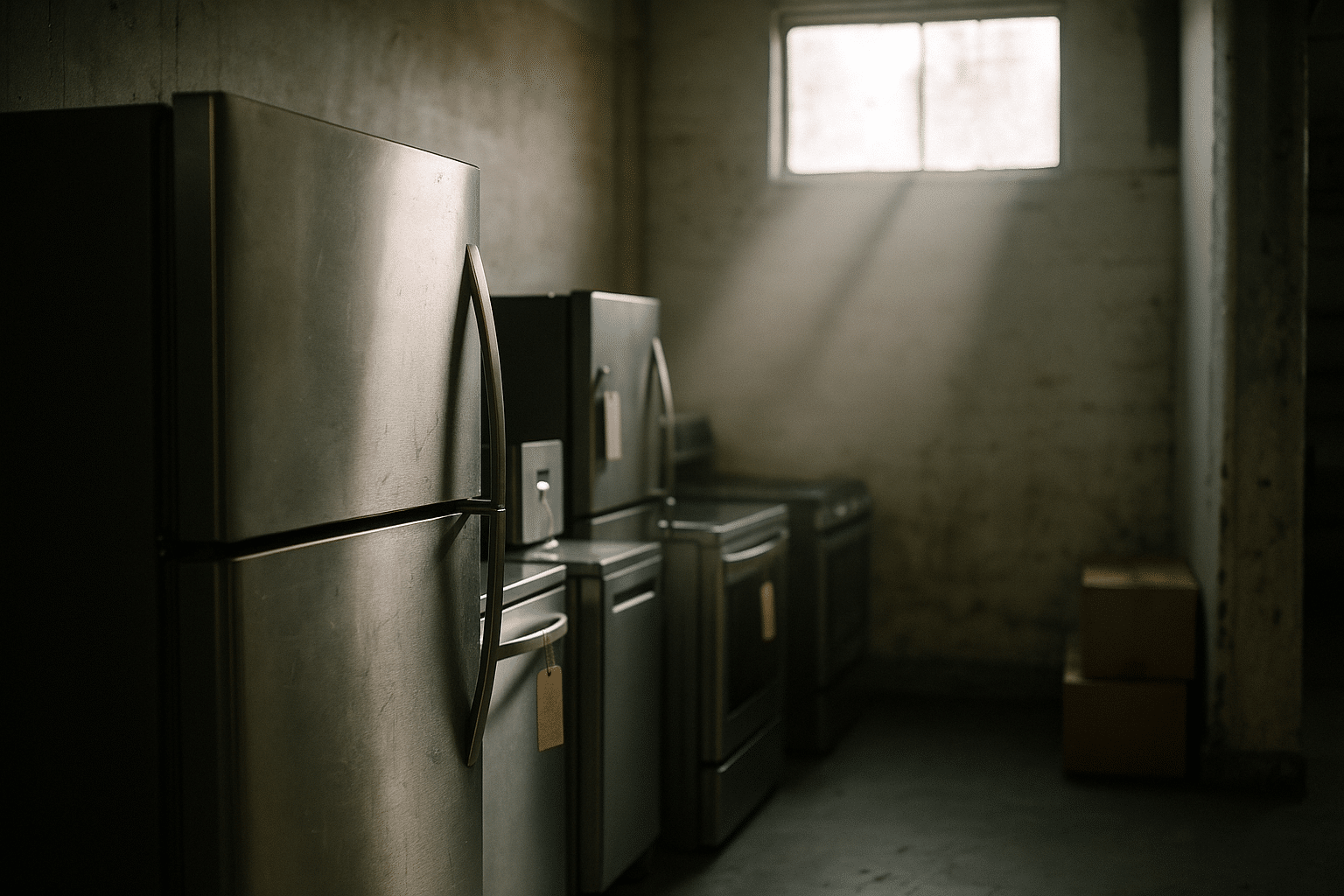

As we connect these threads, think of a store as a living ecosystem. Shelves are habitats, items are seasonal species, and price tags are the weather—warming during launch, temperate in maturity, and finally cooling in decline. That cooling phase is where clearance lives. The trick is recognizing whether a markdown signals true value or simply a price chasing demand. Appliances often enter clearance due to model updates or inventory rotation.

Retail Clearance Basics in Practice

Clearance is the clean finish to a product’s in-store storyline. It typically starts with a small markdown to test elasticity and concludes when either the last unit sells or the remaining units are diverted to off-price channels. Stores use markdown ladders—progressive steps such as 10%, 20%, 30%, and so on—to balance speed with recovery. The cadence varies by category and by how urgently space is needed for incoming assortments, seasonal resets, or planogram changes.

Why do everyday items end up on clearance? The reasons are practical rather than mysterious:

– Floor-space pressure: high-velocity or seasonal sets need room, forcing slower SKUs to exit.

– Assortment refresh: new finishes, features, or packaging make older versions less compelling at full price.

– Demand mis-forecast: a buyer’s optimism meets a quieter-than-expected season, and inventory must be right-sized.

– Vendor agreements: mark-down allowances or return-to-vendor clauses can reduce risk and accelerate decisions.

– Quality perception: even minor box wear or open-box returns can relegate otherwise functional items to the clearance corner.

Execution matters as much as intent. Clear signage, restaged shelves, and clean presentation protect a store’s reputation and help customers find good value without feeling they’re buying leftovers. Many retailers use a “last chance” bay so clearance items don’t distract from regular price shelves. Others integrate clearance into the main aisle to preserve discoverability. Both approaches work when they align with the store’s traffic patterns and category adjacencies. For example, placing discounted water filters near the plumbing aisle contextualizes the purchase, while consolidating unsold seasonal heaters in one area helps bargain seekers browse efficiently.

Markdown decisions also weigh hidden costs. Holding inventory ties up cash and increases shrink risk, while too-aggressive discounting can train shoppers to wait. Smart operators analyze sell-through at each step of the ladder to identify the price point where velocity meaningfully improves without eroding margin more than necessary. Over time, that data refines initial buys and reduces the need for end-of-season fire sales. The goal is not only to sell what’s left, but to learn enough to avoid overbuying again.

Inventory Turnover, Sell-Through, and Margin Math

Inventory turnover is the speedometer of retail performance. Formally, turnover equals cost of goods sold divided by average inventory. If a store posts $1,000,000 in cost of goods sold and holds an average of $250,000 in inventory, turnover is 4. That translates to roughly 91 days of supply (365/4), an important indicator of how quickly cash invested in stock returns to the register. Clearance affects this by converting stagnant units into sales, improving turnover and reducing carrying costs, even if the gross margin percentage drops.

Two companion metrics keep the picture honest. First, sell-through measures units sold divided by units received within a time window, helping teams see how a specific buy is performing. Second, GMROI (gross margin return on investment) assesses the dollars earned for each dollar invested in inventory. Clearance can improve GMROI when stale items are converted into dollars that can be reinvested in faster sellers. However, markdowns must be intentional: taking an extra 20% off that only moves a few units may harm GMROI if the recovered cash is minimal.

Typical turnover ranges vary by category and sourcing model. Fast, replenishable goods can run double-digit turns. Larger, durable items often live between 3 and 6 turns, depending on price points and display depth. Seasonal categories swing widely: patio heaters might peak in autumn and plunge in spring. Recognizing these rhythms helps teams forecast, buy tighter, and time markdowns. It also explains why some items transition faster than others based on lifecycle length and innovation cadence. Appliances often enter clearance due to model updates or inventory rotation.

Consider a practical example. A store has 40 units of a mid-priced item, moving two per week. At that pace, weeks of supply is 20—too high with a new assortment arriving in eight weeks. A small markdown nudges weekly sales to three, cutting weeks of supply to 13. A final, deeper cut can time the sell-out to the delivery window, freeing space without resorting to wholesale liquidation. When multiplied across dozens of SKUs, this approach preserves working capital, speeds floor resets, and stabilizes cash flow.

Product Cycles and Markdown Timing

Every product rides a cycle: introduction, growth, maturity, and decline. Clearance typically appears in late maturity or early decline, once full-price demand softens or a successor enters the stage. The length of this cycle depends on how fast a category innovates. Rapid-cycle items turn the wheel in months; long-cycle items may take years. In both, the transition moment—when a replacement is announced or a finish is retired—often triggers price elasticity changes that justify markdowns.

In planned transitions, merchants build a “bridge.” First, they trim depth on the outgoing model to avoid excess. Next, they bundle accessories or offer modest discounts to spur sell-through without collapsing margin. Finally, if inventory remains, clearance escalates to ensure a clean handoff. The goal is to avoid a confusing aisle where old and new versions sit at similar prices, which can stall both lines. Clear visual cues, concise messaging, and accurate specs help shoppers understand what’s changed and why the value equation tilts.

Lifecycle strategy also considers parts and support. A well-managed exit still accounts for warranty coverage, availability of filters or consumables, and returns handling. Those elements reassure buyers scouting value during markdown periods. On the operator side, recognizing early “tell” signs—like supplier pre-announcements, packaging changes, or colorway consolidations—lets teams throttle orders and plan display space so the clearance phase is brief and tidy. Seasonal cadence matters too: outdoor items often wind down just before weather shifts, while indoor items may taper when major promotions conclude.

Comparing categories clarifies timing. Rapid-fashion goods trade novelty for speed; delayed markdowns risk obsolescence. Long-life goods prioritize serviceability and feature clarity; discounts arrive more sparingly and are paired with assurance about support longevity. For shoppers, that means patience can pay off in slower-cycle categories, while decisiveness helps in faster ones where desirable configurations disappear quickly. The art lies in reading the room: how crowded is the shelf, how recently did signage change, and how close is the next promotional event? Those cues tell you whether to buy now or wait for the next price step-down.

Conclusion: A Practical Playbook for Shoppers and Store Teams

Clearance rewards timing, context, and discipline. For shoppers, the value is finding durable goods priced to move without compromising on warranty or function. For store teams, the win is unclogging space and transforming idle stock into cash that can fund the next season. The shared principle is velocity with intent: selling faster while learning smarter. Here’s a compact playbook you can use today.

For shoppers:

– Scan the aisle for signals: consolidated displays, new packaging nearby, or fresh spec cards replacing older ones.

– Check condition tiers: sealed box, open box, and scratch-and-dent each warrant different discounts.

– Confirm support: warranty terms, missing parts policies, and return windows turn bargains into dependable buys.

– Map the calendar: season-end transitions and pre-announced upgrades often precede sharper markdowns.

For store teams:

– Build a measured markdown ladder and review sell-through weekly; adjust only when velocity data supports it.

– Protect GMROI with vendor support—negotiate markdown funds and ask for swap allowances on overbuys.

– Stage clearance cleanly to preserve brand perception of the department and reduce shopper friction.

– Feed learnings back into buying: tighten initial orders where historical sell-through lagged, and allocate space to proven movers.

Across categories, patterns repeat. New arrivals compress shelf space, slower sellers drift toward the edge, and pricing responds to the drumbeat of incoming assortments. Appliances often enter clearance due to model updates or inventory rotation. When you interpret those moves through the lenses of turnover math and product cycles, clearance stops feeling like a gamble. It becomes a predictable moment where informed shoppers save responsibly and well-prepared retailers maintain healthy cash flow. The result is a cleaner aisle, a better experience, and fewer surprises during the next reset.